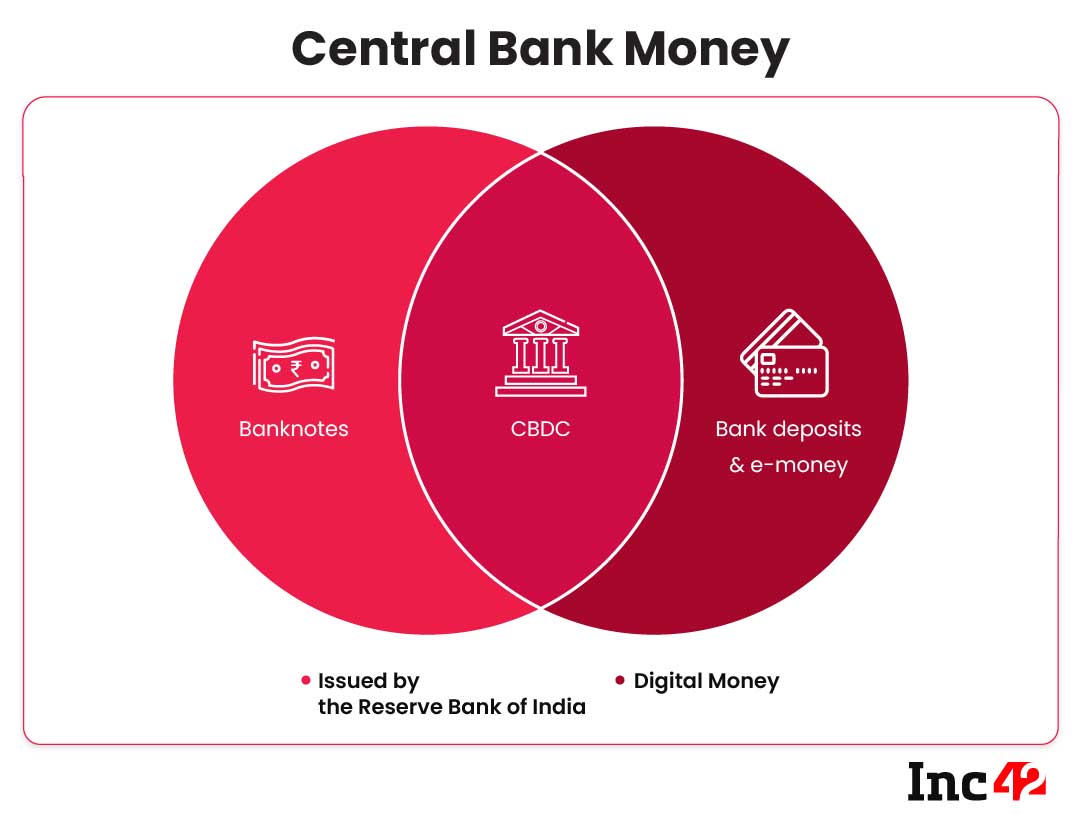

A Central Bank Digital Currency (CBDC) is a digital form of a country’s official currency issued and regulated by the central bank. Unlike cryptocurrencies such as Bitcoin or Ethereum, CBDCs are issued and backed by a government authority, making them a form of legal tender. CBDCs represent the evolution of traditional fiat currencies into the digital age and have the potential to reshape the financial system in several significant ways.

Key Characteristics of CBDC:

- Backed by Central Authority: CBDCs are issued and regulated by central banks, ensuring their stability, legal status, and trustworthiness.

- Digital Representation of Fiat: CBDCs mirror the value of physical currency but in a digital form, enabling electronic transactions and storage.

- Legal Tender: CBDCs are recognized as an official means of payment, just like physical cash.

- Secure and Traceable: CBDC transactions are recorded on a secure and transparent digital ledger, allowing for efficient traceability and reducing the risk of fraud.

- Instant Transactions: CBDC transactions can occur in real-time, facilitating faster and more efficient payments.

- Cross-Border Transactions: CBDCs could potentially simplify and expedite cross-border transactions, reducing the need for intermediaries and foreign exchange conversions.

- Privacy Concerns: While CBDCs offer transparency, concerns about privacy and surveillance have been raised, prompting central banks to strike a balance between traceability and user privacy.

Impact on the Financial System:

- Payment Efficiency: CBDCs could streamline payment systems, reducing the need for intermediaries and enabling immediate transactions, leading to faster and more cost-effective payment processes.

- Financial Inclusion: CBDCs could extend financial services to unbanked and underbanked populations, as they would only require a digital device to access and use CBDCs.

- Reduced Costs: CBDCs could lower transaction costs for both individuals and businesses by eliminating the need for physical cash handling and reducing reliance on third-party payment processors.

- Monetary Policy and Control: Central banks could exercise more precise control over monetary policy by directly influencing the circulation and velocity of money through CBDCs.

- Financial Stability: CBDCs could enhance the stability of the financial system by providing a secure and traceable means of payment, reducing the risk of financial crimes.

- Disintermediation: CBDCs could disrupt traditional banking and payment systems, potentially reducing the role of commercial banks in payments and lending.

- Cross-Border Transactions: CBDCs could simplify cross-border trade and financial transactions, reducing costs and increasing efficiency.

- Competition with Cryptocurrencies: CBDCs might compete with existing cryptocurrencies and stablecoins, potentially influencing the regulatory landscape for these assets.

- Reduced Dependence on Cash: CBDCs could accelerate the decline in the use of physical cash, potentially impacting industries that rely on cash transactions.

- Enhanced Data Insights: CBDC transactions generate data that central banks can use for better understanding economic trends and making informed policy decisions.

In conclusion, the introduction and adoption of Central Bank Digital Currencies have the potential to bring about significant changes to the financial system. While the full implications are still unfolding, CBDCs offer the promise of improved payment efficiency, financial inclusion, and better monetary policy control. As central banks worldwide explore and experiment with CBDCs, careful consideration of the technology, privacy concerns, and potential impacts on the financial ecosystem will be crucial in realizing the benefits of this innovation while managing any associated risks.

Key differences between Central Bank Digital Currency (CBDC) and traditional physical currency:

| Aspect | Central Bank Digital Currency (CBDC) | Traditional Physical Currency |

|---|---|---|

| Form | Digital representation of official currency issued by central bank. | Physical coins and banknotes. |

| Issued by | Central bank, backed by government authority. | Central bank and government authority. |

| Physical Presence | Exists purely in digital form. | Exists in physical form as coins/banknotes. |

| Legal Tender | Recognized as an official means of payment. | Recognized as an official means of payment. |

| Transaction Speed | Can facilitate near-instantaneous transactions. | Transactions involve physical exchange. |

| Security and Fraud | Transactions recorded on a secure and traceable digital ledger. | Risk of theft, counterfeiting, etc. |

| Cost Efficiency | Potentially reduces transaction costs and eliminates the need for cash handling. | Costs associated with minting and distributing physical currency. |

| Financial Inclusion | Could enhance access to financial services for unbanked/underbanked populations. | Accessibility depends on physical proximity to banks/ATMs. |

| Monetary Policy Control | Enables central banks to exercise more precise control over monetary policy. | Limited control over money circulation and velocity. |

| Privacy Concerns | Balancing transparency and user privacy is a challenge. | Transactions may offer more anonymity. |

| Cross-Border Transactions | Could simplify and expedite cross-border transactions. | Cross-border transactions may involve intermediaries and currency conversion. |

| Environmental Impact | Potential energy consumption concerns due to digital nature. | Involves the use of physical resources. |

It’s important to note that CBDCs and traditional physical currency each have their own advantages and challenges. While CBDCs offer the potential for greater efficiency, financial inclusion, and enhanced monetary policy control, traditional currency remains tangible and universally accepted. The coexistence of both forms of currency could shape the future of payments and financial systems, catering to different preferences and use cases.

Countries Ahead in the race of CBDC

Several countries are actively exploring and developing Central Bank Digital Currencies (CBDCs) as part of their efforts to modernize their financial systems and stay at the forefront of digital innovation. While the progress and priorities vary from nation to nation, here are some countries that are considered to be ahead in the race of CBDC development:

- China: China has made significant strides in CBDC development with its digital currency known as the Digital Currency Electronic Payment (DCEP), also referred to as the digital yuan. China has been conducting pilot tests and trials of the digital yuan in various cities, and it has become one of the most advanced CBDC projects globally.

- Sweden: The Riksbank, Sweden’s central bank, has been exploring the concept of an e-krona for several years. Sweden has a declining use of cash, making it a prime candidate for a digital currency. The Riksbank has conducted various phases of testing and is actively studying the potential implications of an e-krona.

- Bahamas: The Central Bank of The Bahamas has launched the Sand Dollar, making it one of the first countries to officially launch a CBDC. The Sand Dollar is designed to improve financial inclusion and accessibility in the archipelago nation.

- United Arab Emirates: The UAE has been actively exploring the development of a digital dirham. The central bank of the UAE has conducted various experiments and collaborations to assess the feasibility of a digital currency.

- Singapore: The Monetary Authority of Singapore (MAS) has been engaged in Project Ubin, a multi-phase initiative exploring the potential use of blockchain and distributed ledger technology for digital payments and settlement. While not a full-fledged CBDC, Project Ubin is a significant step toward a digital currency ecosystem.

- Canada: The Bank of Canada has been researching and experimenting with CBDC concepts, including working on prototypes and collaborating with partners to better understand the implications of a digital currency.

- European Union: The European Central Bank (ECB) is actively exploring the potential issuance of a digital euro. The ECB has launched a digital euro project to assess the technical and policy considerations of introducing a digital currency in the eurozone.

- United States: The U.S. Federal Reserve has been studying CBDCs and engaging in discussions about the potential benefits and challenges. While the U.S. is taking a cautious approach, it recognizes the importance of staying informed about digital currency developments.