In an era where mental health is gaining overdue recognition, it is crucial to demystify the significant role that health insurance plays in enabling access to essential care. Mental health issues affect countless individuals globally, yet unraveling the intricate landscape of health insurance coverage for mental health services can be a complex and often overwhelming endeavor. This article delves into the vital aspects of comprehending coverage and accessibility for mental health services within your health insurance plan.

The Significance of Mental Health Coverage

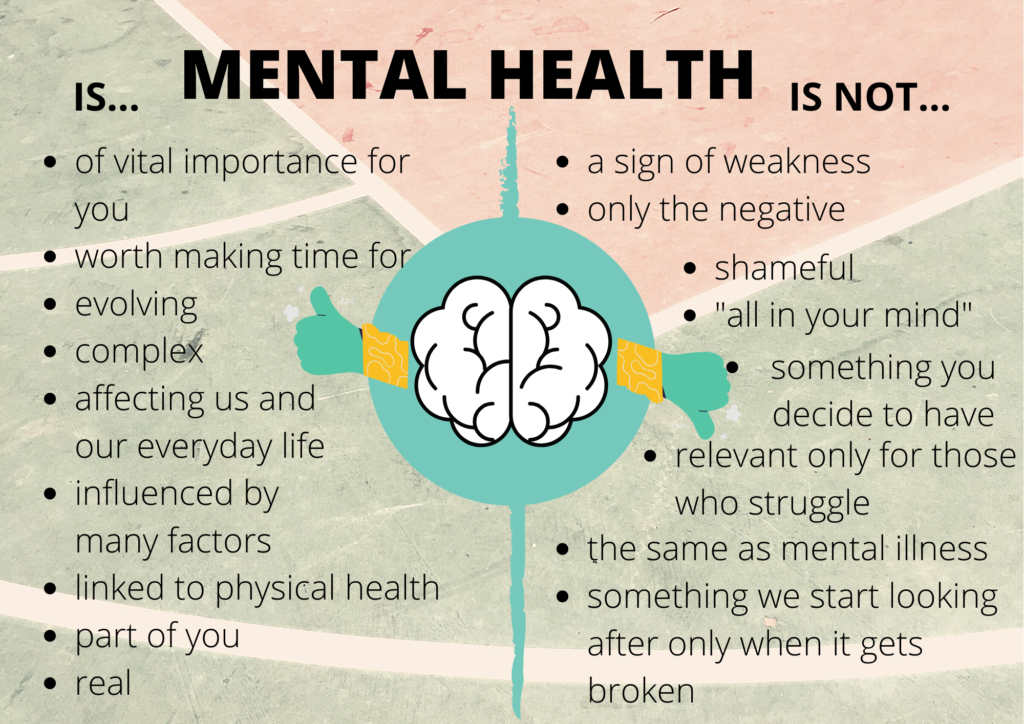

Mental health is a fundamental component of overall well-being. For many years, mental health services were often underestimated or underfunded in health insurance plans. Fortunately, substantial progress has been made through the enactment of mental health parity laws. These laws mandate insurers to treat mental health services at par with physical health services. While these laws may vary from state to state, their core objective remains the same: ensuring that individuals have equitable access to mental health care.

Unraveling Mental Health Parity Laws

Mental health parity laws signify a significant leap forward in improving mental health coverage. They dictate that insurers must provide coverage for mental health and substance use disorder services on the same footing as they do for medical and surgical services. This means that co-pays, deductibles, and annual limits should be consistent for both mental health and physical health services.

Nevertheless, it is essential to recognize that these laws may differ from one state to another, and not all insurance plans may be fully compliant. Therefore, understanding your state’s specific laws and advocating for your rights as a policyholder is of utmost importance.

Categories of Mental Health Services

Mental health services encompass a wide range of treatments and interventions, including therapy, counseling, psychiatric care, and medication management. An in-depth understanding of how these services are accommodated within your insurance plan is crucial. Here are key aspects to consider:

- Therapy and Counseling: Many insurance plans provide coverage for therapy and counseling services. It is crucial to verify whether your plan covers individual, group, or family therapy and understand the allowable number of sessions.

- Psychiatric Care: Unrestricted access to psychiatric care is vital for individuals dealing with severe mental health conditions. Check if your plan includes coverage for psychiatric evaluations, medication management, and follow-up appointments.

- Medication Coverage: Some plans may have formularies governing the prescription of psychiatric medications. Ensure that your prescribed medications are on the formulary or understand the process for requesting exceptions.

Navigating Network Constraints

Health insurance plans often feature networks of preferred providers, and obtaining mental health care within these networks can be more cost-effective. Consider these critical factors:

- In-Network vs. Out-of-Network: In-network providers typically result in lower out-of-pocket costs. Verify whether your preferred mental health provider is in-network, and if not, assess the potential financial implications.

- Out-of-Network Coverage: Understand the extent of coverage for out-of-network mental health services offered by your plan. Some plans may provide partial coverage, while others may involve higher out-of-pocket expenses.

Prior Authorization and Coverage Limitations

Health insurance plans may require prior authorization for mental health services and impose limitations on coverage. These requirements can sometimes be complex:

- Prior Authorization: Familiarize yourself with the process of obtaining prior authorization for mental health services. Ensure that your provider submits the necessary documentation to secure approval.

- Coverage Limitations: Stay informed about restrictions regarding the number of therapy sessions or psychiatric appointments covered within a specific timeframe. Some plans may require reauthorization for continued care.

Exploring Alternative and Complementary Therapies

Holistic approaches to mental health, such as acupuncture, mindfulness programs, and other complementary therapies, are gaining recognition. Investigate whether your insurance plan covers these alternative treatments and gain insight into any associated requirements or limitations.

Appealing Coverage Denials

If your insurance provider denies coverage for a mental health service, you have the right to appeal the decision. While the appeals process can be intricate, persistence can lead to favorable outcomes. Seek guidance from your provider and leverage available resources to strengthen your case.

Telehealth and Mental Health Services

Telehealth has transformed access to mental health care, especially in remote or underserved areas. Determine whether your insurance plan includes coverage for telehealth services and become familiar with the specific requirements for virtual mental health appointments.

Employer-Sponsored Plans vs. Individual Plans

The type of insurance plan you have, whether it is an employer-sponsored plan or an individual plan, can impact your mental health coverage:

- Employer-Sponsored Plans: These plans often provide comprehensive mental health coverage, but details may vary. Consult your HR department or benefits coordinator to understand the nuances of your plan.

- Individual Plans: For individual insurance plans, thorough research of available options is crucial. Some plans may offer robust mental health coverage, while others may impose limitations.

Resources for Assistance

Navigating health insurance for mental health services can present challenges, but you are not alone. Numerous resources and organizations are available to assist:

- Mental Health Advocacy Groups: Organizations like the National Alliance on Mental Illness (NAMI) offer guidance and support in understanding your rights and advocating for improved mental health coverage.

- Legal Aid Services: In cases involving insurance disputes, legal aid services can provide legal assistance and advice.

Mental health is a fundamental aspect of holistic well-being, and health insurance should facilitate equitable access to necessary services. By gaining a comprehensive understanding of your health insurance plan’s coverage and accessibility for mental health services, you can take proactive steps to ensure you receive the care you require. It is crucial to stay well-informed, advocate for your rights, and seek assistance when needed. Mental health is of utmost importance, and your insurance plan should reflect this reality accurately.